Where can I earn the most?

This post is outdated. See our new article instead.

Since one way you can have a big impact with your career is through earning to give, we have an on-going project to work out how much you can expect to earn in different career paths.

Our most recent research looked at the typical career paths and salaries for five different careers:

- Accounting

- Consulting

- Investment Banking

- Law

- Medicine.

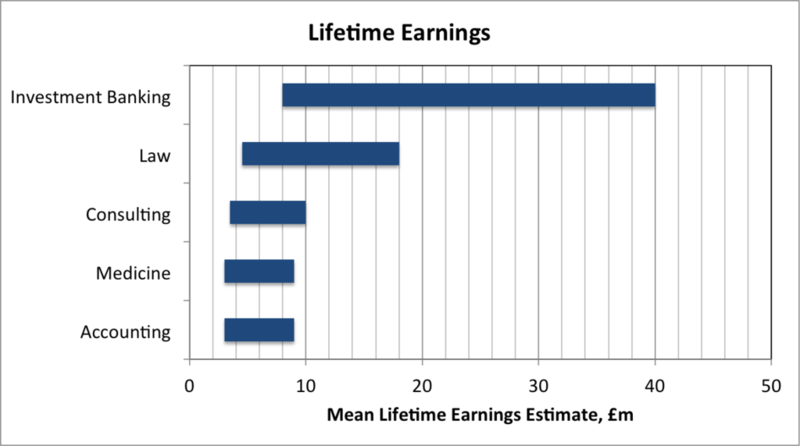

We found that investment bankers have the highest earning potential. In the UK, an investment banker can expect to earn between £8 million and £40 million over the course of their career.

You can make more refined estimates for your individual situation by considering a number of personal factors, such as where you live and your ability relative to your peers.

In some upcoming posts, we’ll look at some ways to maximise your earnings within specific careers. We’ll cover entry requirements, the best places to work, and which exit opportunities are the most promising. We will also look at some of the major differences that we’ve found between earnings in the UK and the USA. In this post, we present a summary of our findings.

So, how much will I earn?

Within each of these broad sectors, we chose one specific career – deal making investment bankers, solicitors, management consultants, public accountants and NHS doctors (including both consultants and GPs) – and estimated how much you could earn if you make it all the way to the top of each particular field. The results of our research suggest that, on average, investment bankers have the highest earning potential, with mean lifetime earnings of between £8m and £40m. As you can see from the graph above, this is significantly higher than lawyers at £4.5m-£18m, consultants at £3.5m-£10m, and accountants and doctors with £3m-£9m.

In order to calculate these expected lifetime earnings, we gathered as much information as we could about the typical career paths. For each position we found information on:

- Base salaries

- Bonus sizes

- How long it takes to reach each level

By combining this information we were able to make an estimate for the lifetime earnings across a career.

Our 80% confidence intervals for mean earnings might appear surprisingly wide, but this is due to a large amount of uncertainty in the data that we are using. This uncertainty is largely due to the fact that performance related pay, such as bonuses and profit shares, forms a significant part of the earnings. This is most prevalent in Investment Banking, which has the largest range, as after the first three years bonuses are frequently larger than the base salaries, and by the time you make it to the Managing Director level they can be worth 10-20 times as much as your base salary in a good year.

Tailoring these estimates to you

Since our estimates don’t account for individual differences, to get a more accurate estimate you’ll want to factor in considerations about your own personal circumstances. Some of the key factors that will influence your earnings are:

- Geography: Salaries vary depending on whether you work in a major city such as London or whether you work in a regional office. In order to work out how much you can actually donate, you’ll also need to consider the variation in living costs across these areas. An increase in earnings might not actually translate into an increase in the amount you can donate if your living costs increase by the same amount, for example.

Which company you work for: In most careers the company that you work for can have a big impact on how much you earn. Aiming for bulge bracket banks, magic circle law firms or the big four accounting firms can help to boost your earnings. Beyond this, identifying which sector or division you’re likely to end up specialising in can also help narrow down your range of expected earnings.

Progression Rate: How quickly you move along your career path will depend upon ability, experience and luck. By looking at some relevant indicators of success for your particular career you will be able to understand how you compare to your peers, enabling you to refine your estimates for how long it will take you to reach the top.

Changes in career path: Another important thing to consider is both dropout rates at different points of the career path, and where the exit opportunities lie. Obviously not everyone gets to become the CEO one day, and you might need to think about when you are likely to move within or leave an industry. Different levels of seniority can also require drastically different skills, so rather than just assuming you will stick out a career to the end, think about which aspects of the job you are likely to be good at and where this may take you.

When making your own estimate it is important to remember that most of the things we are dealing with aren’t fixed. Job markets, careers, industries will all change between now and the end of your career. Your own abilities and preferences are unlikely to remain unchanged either. Update your models and estimates as you progress through your career, taking account of where you are, what you have learnt and where opportunities are likely to open up in the future. By assessing all this you will be able to periodically examine your career and make better informed choices about when and where to move, leave or jump to.

Maximising your earnings

In some future posts, we’ll look more in depth at maximising earnings in Banking, Medicine, Law, Accounting, and Consulting by considering:

- The minimum entry requirements and how to get in

- Which firms, divisions and sectors offer the highest earnings

- What the exit opportunities are for each career and when you should take them

- Some of the best sources we have found for additional guidance and information.

You might also enjoy our series on estimation:

- How to go about estimating lifetime earnings,

- How to make estimates of hard-to-measure quantities in general